Skoda Auto keeps a close eye on the Indian automobile market

With the so-called INDIA 2.0 project, the Volkswagen subsidiary Skoda is attempting to make a fresh start on the subcontinent, this time with vehicles individually tailored to the Indian market. Cooperation with Suzuki and Tata Motors had already failed even before the development or introduction of new vehicles. For Skoda Auto, the new project is of enormous strategic importance, as a completely new model family is planned for the region. Skoda will use a modified version (A0-IN) of the Volkswagen MQB platform A0, as it has all the necessary safety and technology standards for India. The Indian government has announced that it will introduce stricter guidelines for vehicles in 2020, the year in which the first Skoda model based on the A0-IN platform will be launched.

Skoda Auto’s HR manager, Bohdan Wojnar, said in an interview with Deutsche Welle (DW) that this time customer preferences will have a much greater impact on vehicle design and development. “Significantly more work will now be done locally directly in India, giving Skoda Auto more freedom and autonomy but also more responsibility,” says Wojnar. Initially, Skoda and Volkswagen vehicles will be developed and produced specifically for the Indian market, and later exported to other Southeast Asian countries or even the Middle East or Africa.

The INDIA 2.0 project led by Skoda is to become an example of optimised and cost-effective product development and, if successful, will be transferred to other emerging markets. The Indian economy is on the upswing and is producing a wealthy middle class. Therefore, despite a mass of budget cars below an average price of 4480 euros, experts expect a growing market for mid-range vehicles. Currently, more than 3 million cars are sold annually in India and India is expected to become the third most important car market after China and the US. In 2017, Skoda sold around 17,000 Rapid, Oktavia, Superb and Kodiaq vehicles in India. The Rapid is produced in Pune, where a new technology center was recently opened, and the remaining models in the plant in Aurangabad. You too can benefit from the growth in India. The export of products there, in particular cars and car parts, in many cases requires obligatory India certification according to the Automotive Industry Standard (AIS). We would be happy to advise you comprehensively on AIS certification for India.

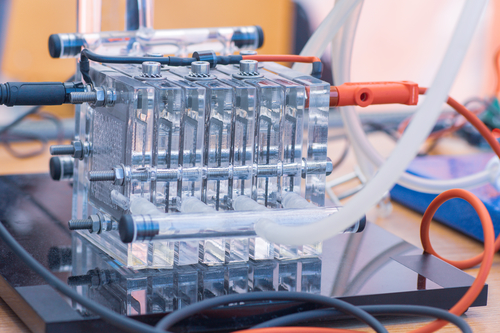

Chinese startup Grove enters the fuel cell car business

The start-up company Grove is another Chinese carmaker that focuses on alternative drive systems, but unlike most of its domestic competitors, Grove plans to drive its vehicles with fuel cells. A development partnership has already been established with the renowned Pininfarina design studio and two concept studies will be presented at the current Auto Shanghai trade fair. Although there are no further technical details about the two vehicles – the Granite sedan and the SUV Obsidian – Grove plans to start series production as early as 2020.

For the introduction and testing of the new models, Grove has agreed to cooperate with a district of the Chinese city of Chongqing and the car rental company Chongqing Panda. The project involves the use of 200 fuel cell cars from Grove. In the following years, an expansion into 20 further Chinese cities with a fleet of 10,000 vehicles is planned. In addition to the Chinese market, Grove plans to sell its cars abroad, including Australia and New Zealand.

Grove Hydrogen is a subsidiary of the Chinese Institute of Geosciences and Environment (IGE), which produces and sells hydrogen from industrial waste. In the coming years, the institute plans to set up the appropriate infrastructure to refuel the hydrogen in large Chinese cities. The car manufacturer Grove has its headquarters in Wuhan and a development and design centre in Barcelona. Further production sites, presumably in China, are to be announced in the course of the year. In addition to Pininfarina’s support in design, Grove has also obtained help from Germany, and there are development partnerships with Hofer Powertrain and the FEV Group. Follow the example of these two companies and take the opportunity to export your products to China. We will be happy to advise you on the China Compulsory Certification (CCC) which is obligatory.

For more information on how CCC certification may affect your company, or for more information about CCC certification in general, the process, and the associated costs, please visit our website and our News Section where you will find current updates twice a week.

Please do not hesitate to contact us for further details and consultation. You can contact us via e-mail, or call us (UK: +44 2071931135, Rest of Europe: +49 69 2713769150, US: +1 773 654-2673).

You can also check out our free CCC-Brochure, which can be downloaded right here as a PDF file or you consult our book (in English) “A Brief Guide to CCC: China Compulsory Certification”, which can be found directly hier on Amazon.

Indian car industry will benefit from electric vehicles

The Indian automotive industry is preparing for a change in the entire industry and hopes to benefit from it. From 1 April 2020, stricter emission standards will apply to vehicles in India that are based on the European Euro VI standard. The new guidelines pose new challenges for automobile manufacturers and suppliers. Electric vehicles in particular are expected to play an important role in the long term.

In order to achieve the reduced emissions, manufacturers will have to develop new, clean engines until electric drives are widespread. Analysts expect suppliers of cast parts used in engine construction, brakes and transmissions to grow by 9 to 11 percent by 2020. However, the same study also advises companies to invest in research and development of components for electric vehicles, as these use around 50 percent fewer cast parts than conventional drives because of the electric motor. In addition, increased demand for control units is expected for both two-wheeled vehicles and cars. In the case of the former, these will replace the carburetor with direct injection and, in the case of larger vehicles, make the combustion and waste gas purification process cleaner.

In contrast, completely new components have to be developed and produced for the production of electric vehicles. Existing automotive suppliers should cooperate with international and domestic OEM manufacturers to benefit from their experience in the field of electric drives. Already, powertrains for electric cars are manufactured in India by foreign manufacturers, and a domestic industry in the field of lightweight components for two-wheelers, passenger cars, hybrid and electric vehicles is under development. In summary, the impact of the introduction of electric vehicles will tend to be medium or long-term, but in any case the automotive industry will benefit. Are you planning to export your products to India? Products in the electric vehicle and automotive sectors must comply with the Indian Automotive Industry Standard (AIS) and undergo India certification (AIS certification). We will be happy to advise you.

China’s declining car sales result of changed customer demands

The automotive industry in China has suffered a decline, but there seems to be new hope. Sales of new cars have fallen for nine months in a row, by 5.2 percent in March. Nevertheless, numerous electric vehicles were presented by domestic startups and renowned foreign car manufacturers at the current Shanghai Auto Show. According to experts, the new operating concept of the vehicles presented, which is based on smartphones, is attracting new customers. So-called New Energy Vehicles, NEV for short, are vehicles with alternative drive systems and recorded an increase of 62 percent in sales figures last year.

According to Fu Qiang, president and co-founder of the electric car startup Aiways, the reason for the popularity of these vehicles is not only the novel drive, but rather the operating concept: “The gloomy mood in the automotive industry is certainly linked to the general economic situation. But in my opinion, customers are not satisfied with the products on offer at the moment,” said Fu, who was previously President and CEO of Volvo Cars China. According to analysts, the current figures are also very often compared with the rapid growth in 2016. This year’s decline is more due to the saturated market in China’s smaller cities, which prefer predominantly domestic brands, while foreign premium manufacturers are far less affected.

Alan Kang, analyst at LMC Automotive Shanghai, told CNBC that the market will recover this year. Despite cancelled subsidies, Kang estimates that sales of alternative drive vehicles will rise from 1 million units last year to 1.5 million. Young buyers, in particular, who are open to new technologies, are making fundamental changes to the traditional car industry. Electric drives, Internet connectivity and intelligent vehicles are the trends of the future for the automotive industry. The Chinese market is therefore still interesting for car manufacturers and suppliers who want to export their products to China. This requires the obligatory China Compulsory Certification (CCC), for which we are happy to advise you.

For more information on how CCC certification may affect your company, or for more information about CCC certification in general, the process, and the associated costs, please visit our website and our News Section where you will find current updates twice a week.

Please do not hesitate to contact us for further details and consultation. You can contact us via e-mail, or call us (UK: +44 2071931135, Rest of Europe: +49 69 2713769150, US: +1 773 654-2673).

You can also check out our free CCC-Brochure, which can be downloaded right here as a PDF file or you consult our book (in English) “A Brief Guide to CCC: China Compulsory Certification”, which can be found directly here on Amazon.

Bosch and ZF remain convinced of China’s growth market

China continues to be the most important and fastest growing market for Bosch’s automotive division, said Stefan Hartung, managing director of the corresponding department of the German conglomerate. “The potential and opportunities for Bosch are enormous in the long and medium term,” said Hartung at a press conference on April 8. Despite weaker demand in China this year, Bosch believes that the market is far from saturated. Statistically speaking, there are 690 cars per 1,000 inhabitants in Germany, compared with only 170 in China. According to Hartung, China will also focus more strongly on mobility services and develop into a leading market for modern mobility.

Even though domestic car sales to private customers in March fell by 12 percent compared with the previous year, Bosch was able to increase its sales in China in 2018 by one percent to 10.5 billion euros. According to Hartung, the Chinese market is only taking a breather. The reasons for this are the customs dispute between the U.S. and China and the slower growth of the economy. Last but not least, many customers would wait for a reduction in the value-added tax announced for April 1 and then make further major investments such as buying a car.

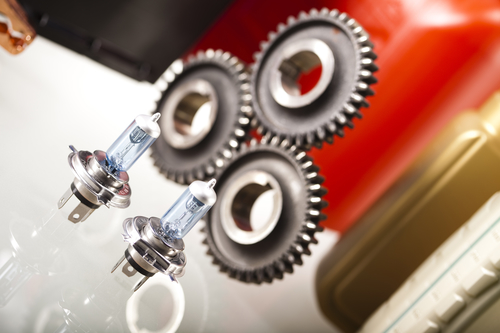

The automotive supplier ZF is also looking forward to a positive market development. The specialist for gears, transmissions, and driveline technology has been selling its products to China for 40 years. Since 1994, the company has also been producing there and since 2004 has been supported by its own local development department. In 2018, the company generated around 20 percent or 6 billion euros of its sales in China. Just recently, ZF was able to announce the largest order in the company’s history. The contract with BMW for the production of an eight-speed automatic transmission has a volume in the tens of billions. These transmissions are to be manufactured at a ZF production facility near Shanghai, where six-speed transmissions were previously manufactured. In addition, ZF is working at its development center in China on the production of an electric motor and the addition of an electric drive to the aforementioned automatic transmission. Do you also have partner companies or subsidiaries in China? We can advise you in the course of a CCC (China Compulsory Certification) and have these carried out for you.

For more information on how CCC certification may affect your company, or for more information about CCC certification in general, the process, and the associated costs, please visit our website and our News Section where you will find current updates twice a week.

Please do not hesitate to contact us for further details and consultation. You can contact us via e-mail, or call us (UK: +44 2071931135, Rest of Europe: +49 69 2713769150, US: +1 773 654-2673).

You can also check out our free CCC-Brochure, which can be downloaded right here as a PDF file or you consult our book (in English) “A Brief Guide to CCC: China Compulsory Certification”, which can be found directly hier on Amazon.

Hyundai and Kia invest $300 million in Indian electric vehicle market

Hyundai Motors and Kia Motors announced in a statement on 19 March 2019 that they would invest $300 million in Ola, India’s leading mobility services provider and taxi hailing service, and its expansion of its electric taxi fleet. The two companies aim to reach the app-based taxi services market and increase their sales of electric vehicles. Last August, Hyundai had already invested $15 million in the newly formed Indian car rental company Revv.

Hyundai and Kia’s collaboration with Ola focuses on the development and production of electric vehicles specifically for the Indian market, the development of the necessary infrastructure and new services based on electric vehicles. According to experts, taxis are the first step and will have a major impact on the acceptance and introduction of electric vehicles in India. In recent years, General Motor, Ford and Toyota have already invested in mobility service providers such as Uber and Lyft. Toyota also made its first investment in the Indian start-up market last year to finance the launch of the used car portal Droom. In February, the Indian company Mahindra launched its own taxi service Glyd, which is operated exclusively with its own manufactured electric vehicles.

These steps reflect a certain sense of optimism in the Indian automotive market. After a slight increase in sales figures of 5 percent to 33.9 million vehicles in 2018, the situation has not improved this year. India’s largest automaker, Maruti Suzuki, which has a 50 percent share of the passenger car market, increased its sales by only 1.1 percent in January. For Ola, the South Korean investment is a life-saving measure for a failed introduction of electric taxis two years ago. Taxi drivers queued at too few charging stations and due to the high cost of an electric car, tricycles costing only a fifth were ultimately used. Working with car manufacturers Hyundai and Kia can help Ola reduce costs by using their internal development and maintenance to implement plans to introduce electric vehicles. Would you also like to export your products to India and benefit from the growth of the automotive market? In many cases, cars and car parts require mandatory India certification according to the Automotive Industry Standard (AIS). We will be happy to provide you with comprehensive advice on AIS certification for India.

India could reach a high proportion of electric vehicles by 2030

The so-called FAME II programme in India appears to have had its first positive effects on the penetration of the automotive market by electrically powered vehicles. According to a report by the Indian NITI and the Rocky Mountain Institute, it is possible that around 80 percent of two-wheelers and 30 percent of passenger cars will be powered electrically by 2030. The report puts concrete oil and CO2 savings through the FAME II programme at 5.4 million tonnes oil and 864 million tonnes of CO2 could be saved over the life of all electric vehicles. In addition to private transport, 70 percent of commercial vehicles and 40 percent of buses will also be equipped with electric drives. In the case of buses, these could cover 3.8 billion kilometers electrically and without direct emissions.

The FAME II programme was decided by the Indian Union in February 2019 and is intended to accelerate India’s transition to environmentally friendly and clean mobility. The electrification of the transport sector is to play the main role, according to a government statement. The support programme is aimed at accelerating the development of electric vehicles, increasing and stabilising economic growth and ensuring the global competitiveness of the Indian automotive industry. The government-related organisation NITI is also calling for cooperation between various ministries to put together a series of measures in the field of electromobility. Among other things, tolls for combustion engines, favorable loans for electric vehicles and separate lanes, areas or parking spaces exclusively for electrically powered vehicles are proposed. The report also mentions the promotion of the production of electric vehicles and batteries through tax benefits and other measures. Would you also like to export your products to India? Electric vehicle and automotive products must comply with the Indian Automotive Industry Standard (AIS) and undergo an India certification (AIS certification). We will be happy to advise you.

The FAME II programme was decided by the Indian Union in February 2019 and is intended to accelerate India’s transition to environmentally friendly and clean mobility. The electrification of the transport sector is to play the main role, according to a government statement. The support programme is aimed at accelerating the development of electric vehicles, increasing and stabilising economic growth and ensuring the global competitiveness of the Indian automotive industry. The government-related organisation NITI is also calling for cooperation between various ministries to put together a series of measures in the field of electromobility. Among other things, tolls for combustion engines, favorable loans for electric vehicles and separate lanes, areas or parking spaces exclusively for electrically powered vehicles are proposed. The report also mentions the promotion of the production of electric vehicles and batteries through tax benefits and other measures. Would you also like to export your products to India? Electric vehicle and automotive products must comply with the Indian Automotive Industry Standard (AIS) and undergo an India certification (AIS certification). We will be happy to advise you.

Chinese luxury car market continues to grow

Despite a generally weaker development of the Chinese car market, the segment of premium and luxury vehicles continues to grow. Consumer confidence remains at a high level and incomes continue to rise, tripling to 23 million households with more than $34,000 in monthly income by 2020. Due to the high demand, the most important manufacturers of luxury vehicles reported positive sales figures last November. Carlos Gomes, Chief Executive Officer of PSA Group China and Southeast Asia, said in an interview that despite a 2 percent decline in the overall Chinese car market, luxury vehicles continue to grow by 15 percent.

According to a report by the Chinese Automobile Manufacturers Association, overall sales fell 1.7 percent while luxury sedans grew 18.8 percent and premium SUVs 3.5 percent. Calculated in total units, in the price segment over 300,000 yuan (US $44,000) about 1.16 million vehicles were sold last year. All major manufacturers of luxury vehicles, including Mercedes-Benz, BMW and Audi, reported positive figures in November.

Mercedes-Benz sold around 603,000 vehicles in the period from January to November 2018 and achieved growth of 11.7 percent. In a press statement last November, the German car manufacturer announced that together with its brand Smart, it is the first premium manufacturer in China to deliver more than 600,000 units in one year. BMW also grew at a double-digit rate, selling 577,000 vehicles in the first 11 months and achieving growth of 6.4 percent over the previous year. The Ingolstadt car maker Audi, which is part of the VW Group, was able to increase its sales by 13 percent. Particularly successful was the model A4L, a long version of the Limousine, which was developed specifically for China. In addition, Audi is planning a brand offensive with more than 10 new models by 2022, including the electric vehicle Audi Q2L e-tron, which will be offered exclusively on the Chinese market from 2019. You want to benefit from the growth in the premium automotive segment and export your products to China? You need the compulsory China Compulsory Certification (CCC), for which we would be pleased to advise you.

For more information on how CCC certification may affect your company, or for more information about CCC certification in general, the process, and the associated costs, please visit our website and our News Section where you will find current updates twice a week.

Please do not hesitate to contact us for further details and consultation. You can contact us via e-mail, or call us (UK: +44 2071931135, Rest of Europe: +49 69 2713769150, US: +1 773 654-2673).

You can also check out our free CCC-Brochure, which can be downloaded right here as a PDF file or you consult our book (in English) “A Brief Guide to CCC: China Compulsory Certification”, which can be found directly here on Amazon.

Volkswagen plans electric SUV for the Chinese market

The first vehicles of the new electric ID model series are not yet on the road, VW is already planning further new studies. While the Wolfsburg-based company has limited its electric offensive to small and medium-sized cars, the ID Roomz study at the Shanghai Motor Show will present a preview of the series production version of a large battery-powered SUV. The SUV is based on the new modular platform MEB of the Volkswagen Group and the market launch, first in China, is announced for the year 2021.

The modular electric car kit, or MEB for short, will also serve as the basis for a compact car expected at the end of this year as well as other planned models such as a compact SUV, a minibus in the style of a retro van and possibly a beach buggy. The Group subsidiaries Seat and Skoda will also develop electric-powered vehicles based on the MEB. The VW Group’s electric vehicles are to go into series production successively from next year.

Further details on the ID Roomz are not yet known. However, with its dimensions of around five metres in length it is likely to be in the class of the conventional VW models Touareg and Atlas, but due to its space-saving battery drive it will offer more interior space. On the market, VW competes with the Tesla Model X, the Jaguar I-Pace and the Mercedes EQC. Volkswagen has not yet provided any information on the price or if and when there will be a market launch in Europe. Automobile manufacturers in China also process components from abroad. Are you active in the automotive sector and would like to export your products to China? We will be happy to advise you on the China Compulsory Certification (CCC) that is absolutely necessary.

For more information on how CCC certification may affect your company, or for more information about CCC certification in general, the process, and the associated costs, please visit our website and our News Section where you will find current updates twice a week.

Please do not hesitate to contact us for further details and consultation. You can contact us via e-mail, or call us (UK: +44 2071931135, Rest of Europe: +49 69 2713769150, US: +1 773 654-2673).

You can also check out our free CCC-Brochure, which can be downloaded right here as a PDF file or you consult our book (in English) “A Brief Guide to CCC: China Compulsory Certification”, which can be found directly hier on Amazon.